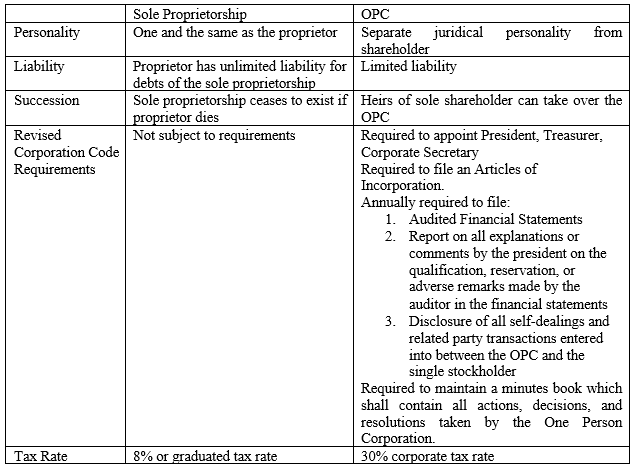

With the introduction of the concept of a One Person Corporation (OPC) in the Philippines, a question is raised for persons who want to set up a business on their own – is it better to set up an OPC or a sole proprietorship? We present five points for consideration.

1. Separate Juridical Personality

A corporation is a separate juridical personality from its shareholders. What this means is that the corporation has an independent existence from that of its individual shareholders. Meanwhile a sole proprietorship is one and the same as its proprietor.

2. Liability

The separate juridical personality of a corporation means that the liability of the corporation is not the liability of its shareholders. The liability of a shareholder for the debts of a corporation is limited only to what the shareholder owes to the corporation. Usually, this is just unpaid capital. If a shareholder subscribed to One Million Pesos worth of shares and paid only One Hundred Thousand Pesos, that shareholder is liable for only Nine Hundred Thousand Pesos. If the corporation owes Ten Million Pesos to creditors, the shareholder is not liable for the whole Ten Million Pesos but only for the Nine Hundred Thousand Pesos of unpaid capital. If the shareholder already fully paid up the One Million Pesos worth of shares, that shareholder is not liable at all for the debts of the corporation. In order for the sole shareholder of the OPC to bring up limited liability, the shareholder must prove that the OPC’s properties are separate from that of the shareholder’s personal properties. Otherwise, the sole shareholder shall be liable for the OPC’s debts.

On the other hand, because the personality of a sole proprietorship is one and the same as its proprietor, whatever the sole proprietorship owes, the proprietor also owes. There is no limit to the liability of the proprietor for the debts of the sole proprietorship.

3. Succession

When the proprietor of the sole proprietorship dies, the existence of the sole proprietorship is also terminated. When the sole shareholder of an OPC dies, his/her legal heirs can continue managing the OPC.

4. Requirements Under the Corporation Code

An OPC is required to appoint a President, Treasurer, and Corporate Secretary. The sole shareholder is automatically the President, but he/she cannot be the Corporate Secretary. The sole shareholder can be both the President and Treasurer, subject to the submission of a bond. Furthermore, OPCs are subject to the regulation of the Securities and Exchange Commission and are required to file articles of incorporation and submit annual reportorial requirements including:

a. Audited Financial Statements

b. Report on all explanations or comments by the president on the qualification, reservation, or adverse remarks made by the auditor in the financial statements

c. Disclosure of all self-dealings and related party transactions entered into between the OPC and the single stockholder

The OPC is also required to maintain a minutes book which shall contain all actions, decisions, and resolutions taken by the OPC.

The sole proprietorship is not subject to any of the aforementioned requirements.

5. Applicable Tax Rate

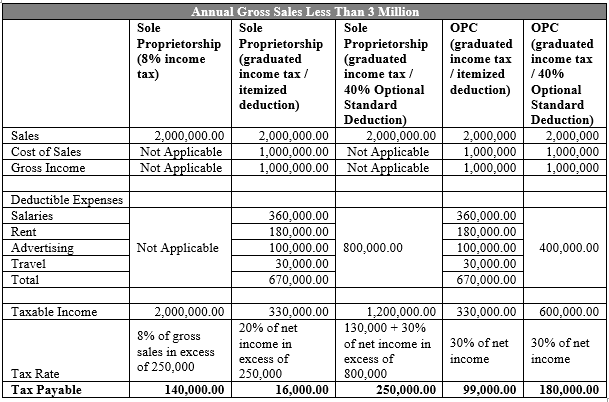

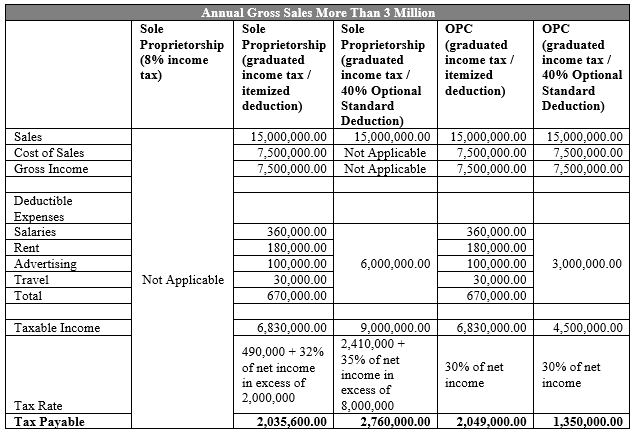

If the gross sales of a sole proprietorship does not exceed Three Million Pesos, it is qualified to claim the tax rate of 8% of its gross sales less Php 250,000.00. If the sole proprietorship’s gross sales exceed Three Million Pesos, or if it does not opt for the 8% tax rate, the graduated tax rate below will apply:

This is not applicable to OPCs, who are subject to the corporate tax rate of 30% of net income.

To illustrate the tax implications, see below sample computations:

Based on the computations presented, a sole proprietorship or an OPC is not necessarily more advantageous over the other. Tax-wise, the best business structure would still depend on the nature of the business.

Summary